Liquidity Provisioning

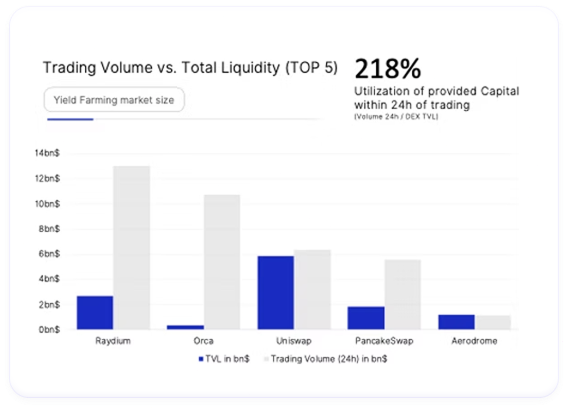

Yieldhaus Capital is a regulated Asset Manager focusing on high performing liquidity provisioning strategies in the Decentralized Finance (DeFi) ecosystem.

Outsized Returns through proven proprietary investment and liquidity provisioning strategies in the emerging Decentralized Finance ecosystem.

Our team provides investors with unparalleled expertise, strong experience, and exclusive access to investment opportunities in this new Ecosystem.

The on-chain verification workflow allows Apps to verify users' credentials inside a Smart Contract. Zero-Knowledge Proof cryptography enables.

Our dedicated Web3 team is actively developing new insurance solutions, services, and capacity to meet emerging risks related to blockchain technology

Interactive strategy overview

Yieldhaus Capital is a regulated Asset Manager focusing on high performing liquidity provisioning strategies in the Decentralized Finance (DeFi) ecosystem.

In order to maximize returns from generated yield and mitigate the risk of Impermanent Loss (IL), Yieldhaus Capital deploys mainly delta-neutral strategies.

Liquidity will be provided across multiple established Layer 1 and Layer 2 protocols, different Decentralized Exchanges (DEX) and invested in a diversified Liquidity Pool (LP) portfolio of blue-chip crypto currencies.

Interactive strategy overview

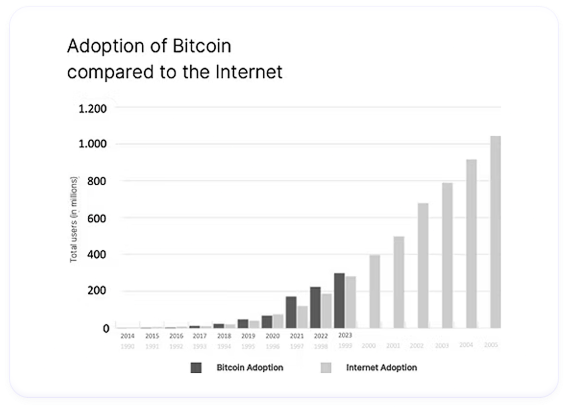

We provide access to a rapidly emerging market with unparalleled adoption rates.

By combining institutional risk management with leading DeFi strategies, we target steady returns, diversification, minimized Impermanent Loss, and peace of mind.

ADJUST. SIMULATE. OPTIMIZE

If you are interested in investing in our regulated DeFi Concentrated Liquidity Fund, our sales team will be happy to provide further information.